The federal government has begun distributing $2,100 stimulus checks to eligible Americans as part of the 2025 economic relief initiative. These payments are being mailed nationwide and are intended to provide much-needed financial support to individuals and families dealing with inflation, high living costs, or income disruptions.

If you haven’t checked your mailbox recently, now might be the time. Millions of payments are being processed this month, and yours could be among them.

Who’s Eligible for the $2,100 Stimulus?

Eligibility for the new stimulus check is based on your 2024 tax return and overall income status. Individuals earning up to $80,000 and joint filers earning up to $160,000 may qualify, especially if they claimed dependents or qualified for earned income or child tax credits.

People on Social Security, disability, or unemployment benefits may also be eligible if they meet the income requirements.

How Are Payments Being Sent?

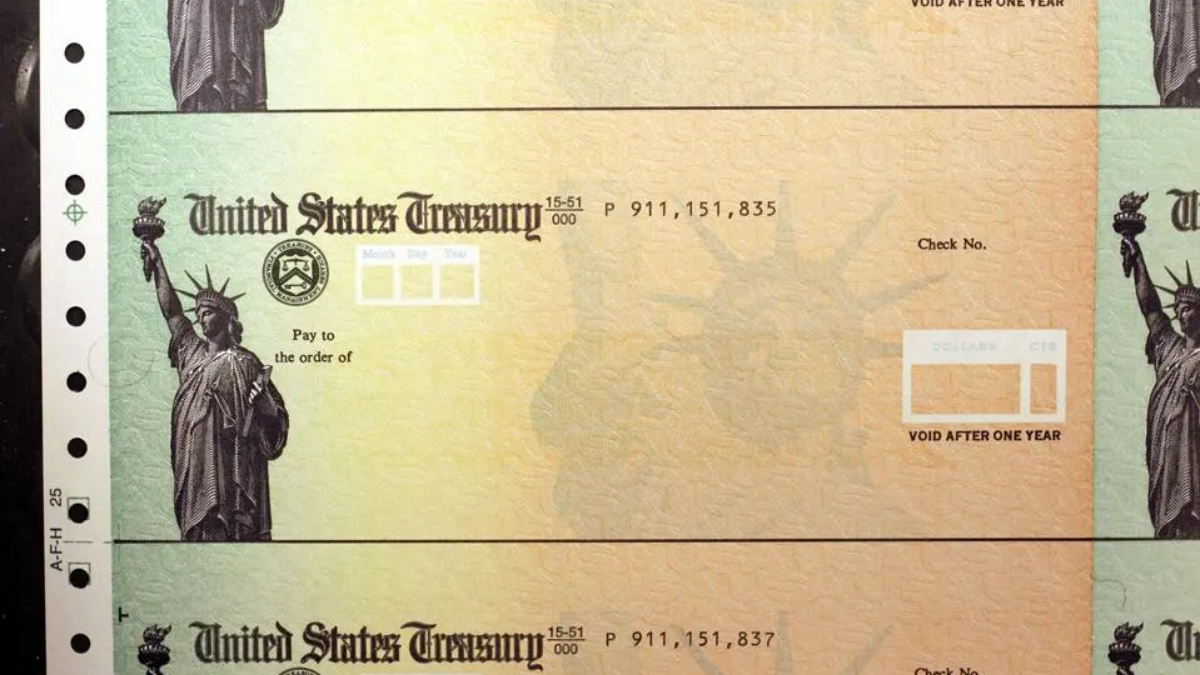

The $2,100 stimulus checks are being sent by mail unless you have direct deposit information on file with the IRS. In that case, you may have already received your payment or will see it in your bank account within days.

Paper checks and debit cards are being mailed out in waves based on location and filing status.

When Should You Expect It?

The mailing process began in early April 2025 and is expected to continue through mid-May. Delivery times may vary depending on your state and how your last tax return was processed.

Table – $2,100 Stimulus Payment Overview

| Detail | Information |

|---|---|

| Payment Amount | $2,100 per eligible individual |

| Delivery Method | Mailed checks or direct deposit |

| Eligibility | Based on 2024 tax return & income |

| Timeline | April to mid-May 2025 |

| Claim Deadline | October 15, 2025 (if not automatically sent) |

The $2,100 stimulus checks offer crucial support to millions of Americans, especially during a period of financial uncertainty. If you meet the income or benefits criteria and filed your taxes for 2024, your payment may already be on the way. Be sure to check your mail, track your payment status with the IRS, and ensure your information is up to date to avoid any delays.

FAQ’s:

1. What if I haven’t received my check yet?

You can track the status of your stimulus check on the IRS “Get My Payment” tool or call the IRS directly for assistance.

2. Can I get the payment if I didn’t file taxes?

Possibly. You’ll need to file a simple 2024 tax return to claim the payment, even if you had no income.

3. Are Social Security recipients eligible?

Yes, many individuals on Social Security, SSDI, or SSI qualify based on income thresholds and will receive their payment automatically.

4. Is this stimulus taxable?

No, the $2,100 payment is not taxable and does not need to be reported as income.

5. What if I moved recently?

Update your address with the IRS or USPS to make sure your check or debit card reaches the correct destination.