Attention part-time workers! The government has announced a $1,900 income stimulus to help those who work part-time or are struggling with fluctuating work hours. If you’re working fewer hours than usual or have been impacted by recent economic challenges, this is your chance to get some financial relief. The application process is simple, but time is limited. Read on to find out if you’re eligible and how you can apply to get your $1,900 stimulus payment today.

What Is the $1,900 Income Stimulus for Part-Time Workers?

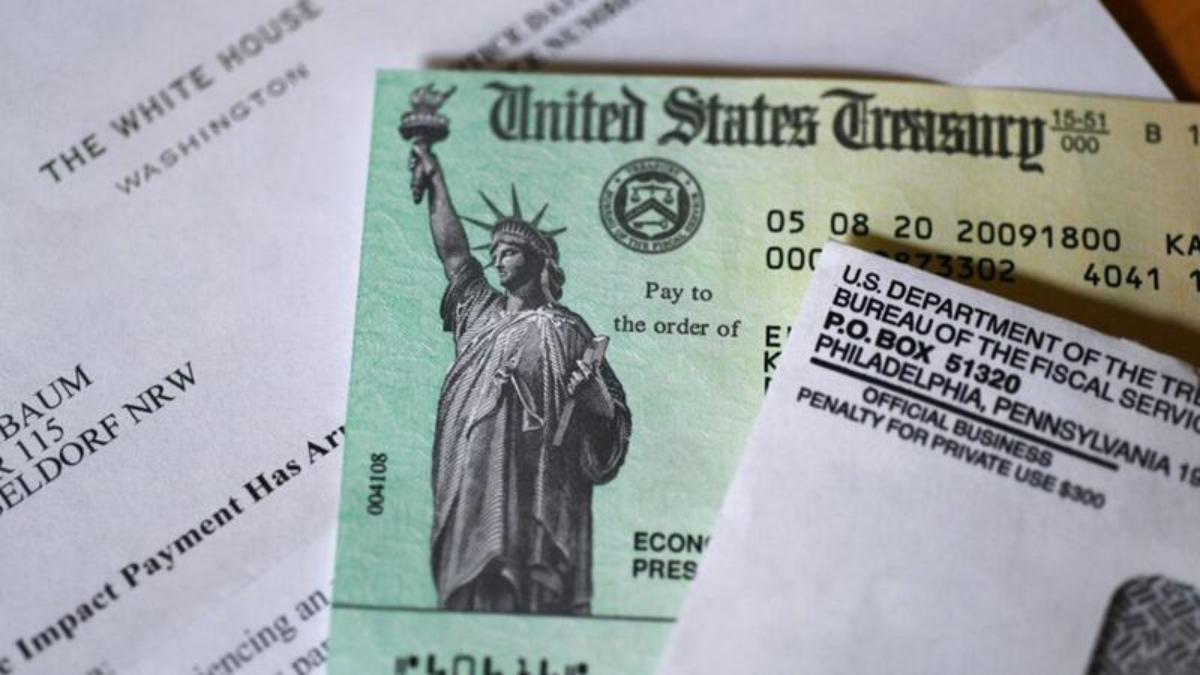

The $1,900 income stimulus is a financial assistance program designed specifically for part-time workers who may not qualify for other forms of assistance like full unemployment benefits. The stimulus is aimed at workers who earn below a certain threshold and have experienced a loss of income or reduced working hours. This one-time payment of $1,900 is meant to provide support for groceries, bills, and other necessary expenses that may have been harder to afford due to limited work hours. It’s a lifeline for many part-time employees who are in need of temporary financial assistance.

Who Is Eligible for the $1,900 Income Stimulus?

Eligibility for the $1,900 income stimulus is based on factors such as income level, part-time employment status, and family size. Below is a table outlining the key eligibility criteria for applicants:

| Eligibility Criteria | Requirement |

|---|---|

| Employment Status | Must be a part-time worker (working less than 40 hours a week) |

| Income Level | Must earn below $45,000 annually for individuals or $90,000 for couples |

| Tax Filing Status | Must have filed taxes for 2022 (or meet IRS registration requirements) |

| Residency | Must be a U.S. citizen or legal resident |

| Dependents | Families with dependents may qualify for additional assistance |

How to Apply for the $1,900 Income Stimulus

The application process for the $1,900 income stimulus is quick and easy. To apply, start by visiting the official IRS website or your state’s financial relief portal. You’ll need to provide proof of your part-time employment and your 2022 tax filings. If you haven’t filed taxes yet, you can still apply, but you may need to submit your tax return or update your IRS account to qualify. Be sure to gather necessary documents like your income statements and proof of employment to complete the process.

Benefits of the $1,900 Income Stimulus

The $1,900 income stimulus offers much-needed financial relief for part-time workers, especially those who have had their income reduced or hours cut. With rising costs and unpredictable work schedules, this stimulus provides flexibility and financial security. Many recipients will use the funds for essentials like rent, utilities, groceries, and healthcare. The stimulus is also designed to help stabilize the financial situation of workers who might not be eligible for full-time work benefits or unemployment.

If you’re a part-time worker, don’t miss out on the $1,900 income stimulus! This financial aid can provide the support you need to cover essential expenses while you navigate uncertain economic times. Make sure to apply now and double-check that you meet the eligibility criteria. The relief is a one-time payment, so be sure to take action before the deadline. This is a great opportunity to ease some of the financial stress you may be facing due to limited work hours.

FAQ’s:

1. How do I know if I qualify for the $1,900 income stimulus?

You qualify if you are a part-time worker, earn under the income limit, and have filed taxes for 2022. Check your IRS account for updates or apply via the IRS portal.

2. How will I receive the $1,900 payment?

Payments will be made via direct deposit (if the IRS has your banking information) or by check. Ensure your contact information is up to date with the IRS.

3. When will the $1,900 income stimulus be distributed?

Once your application is approved, payments will be processed in batches. Expect to receive your payment within a few weeks after submission.

4. Is the $1,900 income stimulus taxable?

No, the $1,900 income stimulus is a non-taxable relief payment. It won’t affect your tax filings for the year.

5. What if I haven’t filed taxes for 2022?

You can still apply for the stimulus, but you’ll need to file a tax return or update your IRS information. This is crucial to qualify for the payment.