Millions of American families are set to receive a $2,750 stimulus relief as part of a new federal initiative targeting low-to-middle income households. This financial boost is aimed especially at families of four, offering extra support to help cover rising costs of living, food, childcare, and utilities in 2025.

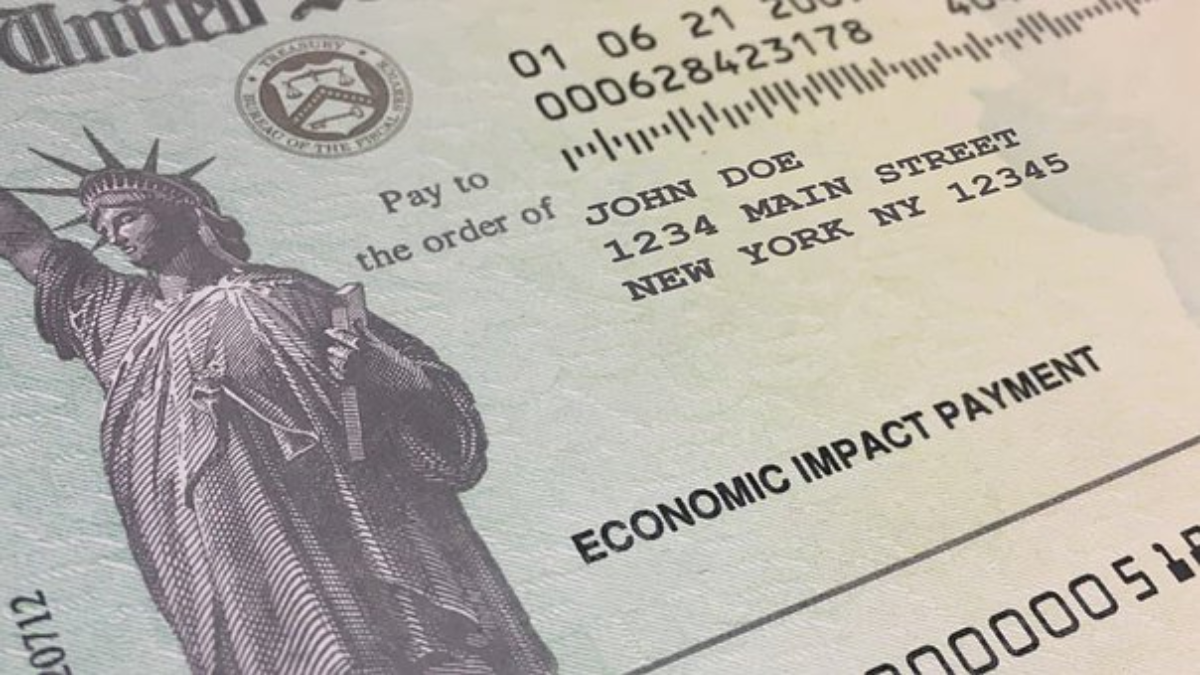

If your household includes two parents and two dependents (or any equivalent family of four structure), you may be eligible to receive this one-time payment—either through a direct deposit or mailed check.

What Is the $2,750 Stimulus Relief?

This stimulus is part of the 2025 Economic Support Act passed by Congress to aid working families. It builds on previous stimulus efforts by focusing on larger households, especially those with dependents, where expenses are often higher and savings are thinner.

The IRS and Department of Health and Human Services are managing the rollout. Eligibility is based on 2024 income, household size, and dependent status.

Table – Breakdown of the $2,750 Stimulus Relief

| Category | Details |

|---|---|

| Total Stimulus Amount | $2,750 per qualifying family of four |

| Distribution Dates | Begins May 2025 and continues through August 2025 |

| Delivery Method | Direct deposit or mailed check |

| Eligibility | Families with 4 members earning under $90,000 annually |

| Filing Requirement | 2024 tax return must be filed (or file by June 15, 2025) |

| Includes Dependents | Yes, children under 17 or other qualifying dependents |

How to Know If You Qualify

To qualify for the $2,750 payment:

- Your adjusted gross income (AGI) must fall below $90,000 for a family of four.

- You must have filed your 2024 federal tax return.

- Your household must include two or more dependents under the age of 17 (or qualifying individuals with disabilities).

- You must have valid Social Security Numbers for all family members.

Payments will be automatically calculated and sent by the IRS, so no separate application is needed if you meet the criteria.

The $2,750 stimulus relief is a vital support measure for families navigating the financial pressures of 2025. If you’re part of a qualifying household, this payment could arrive as early as May—providing a much-needed financial cushion. Be sure your 2024 taxes are filed and your household information is up to date with the IRS to avoid any delays.

FAQ’s:

1. What if my family includes more than four people?

The $2,750 is based on a typical family of four. Larger families may receive additional amounts depending on the number of qualifying dependents.

2. When will I receive my payment?

Payments are expected to begin in May 2025 and continue through the summer. Most will be issued automatically if you’re eligible.

3. Will this payment affect other benefits like SNAP or Medicaid?

No. The stimulus is not considered income and won’t impact your eligibility for other federal aid programs.

4. What happens if I didn’t file my 2024 taxes yet?

You need to file by June 15, 2025 to qualify. Late filing could delay or disqualify your household from receiving the payment.

5. How can I check my payment status?

Visit IRS.gov/GetMyPayment or use the IRS2Go app to track your payment and confirm your eligibility status.