The IRS has announced a special $1,900 refund boost for eligible taxpayers, offering a timely financial lift for millions across the U.S. This enhanced refund is part of updated federal relief measures and tax credit adjustments for 2025. If you’ve filed or are planning to file your taxes soon, here’s how to claim the extra money before the opportunity expires.

Who Qualifies for the $1,900 Boost?

The refund boost targets middle- and low-income taxpayers, particularly those who meet the following criteria:

- Earned under $85,000 individually or $170,000 jointly

- Claimed dependents on their 2024 tax return

- Were eligible for Earned Income Tax Credit (EITC) or Child Tax Credit (CTC)

- Filed taxes by the April 15, 2025, deadline or requested an extension

Taxpayers who missed out on certain credits last year may also qualify for retroactive adjustments.

How to Claim Your Refund Boost

If you’ve already filed your taxes, the IRS will automatically adjust your return and send the additional refund if you qualify. No further action is needed unless the IRS requests additional documents.

If you haven’t filed yet:

- Be sure to claim the full EITC and CTC if eligible

- Use IRS Free File or consult a tax professional

- Double-check your direct deposit information for faster payout

When Will You Get Paid?

The IRS started processing these refund boosts in early April 2025. Most qualifying taxpayers will see the extra funds within 2–3 weeks of their return being processed.

Table – $1,900 IRS Refund Boost Summary

| Criteria | Details |

|---|---|

| Amount | $1,900 |

| Eligible Recipients | Low/middle-income tax filers |

| Key Tax Credits Required | EITC, CTC, or amended returns |

| Filing Deadline | April 15, 2025 (or extension) |

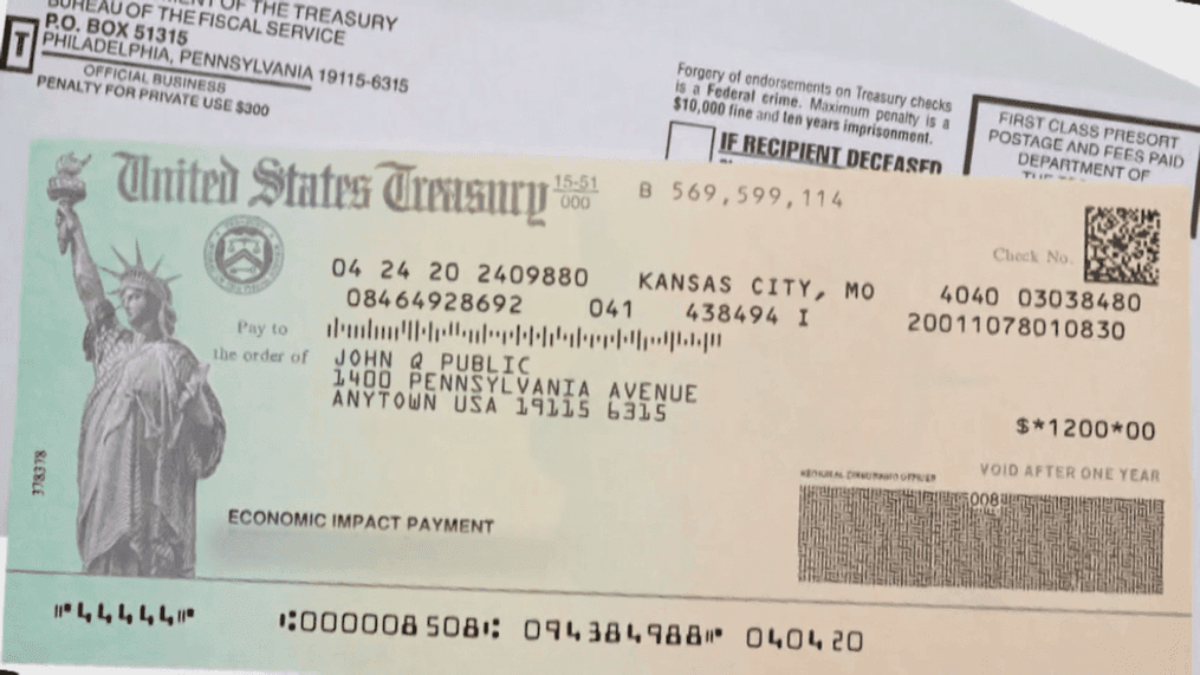

| Payout Method | Direct deposit or mailed check |

The $1,900 IRS refund boost offers meaningful financial relief for millions of Americans. Whether you’re a parent, a low-income worker, or someone who missed credits last year, there’s a good chance you qualify. File on time, check your eligibility, and let the IRS take care of the rest. A few simple steps could bring a welcome boost to your wallet.

FAQ’s:

1. What if I already filed my taxes? Will I still get the boost?

Yes. If you qualify, the IRS will automatically recalculate your refund and issue the additional payment.

2. Is the $1,900 boost taxable income?

No, this refund is not considered taxable and won’t affect next year’s return.

3. Can I get the boost if I didn’t file taxes last year?

Yes, but you must file for 2024 and claim any eligible credits to qualify for the boost.

4. What if I filed with the wrong bank information?

The IRS will mail a paper check to your registered address if the direct deposit fails.

5. How do I know if I qualified for EITC or CTC?

Check your tax return summary or use the IRS online eligibility tools. A tax preparer can also confirm your status.